From Hedge Funds to Early-Stage Investing with George Robinson - Oxford Investment Consultants

“The challenge for us, is to educate people… I'm very happy to share whatever knowledge we've acquired with others to help get them up the learning curve.”

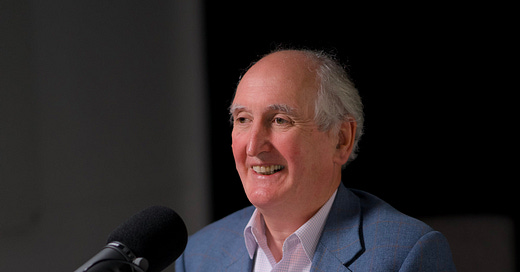

George Robinson

💥 Live now! 💥 George Robinson, founding partner of Oxford Investment Consultants, talks about the unique challenges of investing in early-stage tech and biotech spinouts from Oxford University. George brings incredible perspective on the risks, rewards, and real work involved in turning academic research into successful companies.

Here are just some of the snippets from our conversation:

💡 Bringing tech and biotech innovations from the university lab to the market requires patience, significant funding, and a deep understanding of both technology and business.

🧠 Team evolution is key - The person leading on day one isn’t necessarily the person to lead in later stages - a solid team that grows with the company is essential.

🔬 Evaluating the market fit carefully is a must - if there isn’t a real need or willingness to adopt, it can block even the best tech.

🌍 In the UK, early-stage capital is more accessible than growth capital, especially for complex or high-risk tech ventures.

📊 Founders should take a grounded approach to valuation by considering invested capital and setting achievable milestones for investor confidence.

If you’re interested in the complexities of high-stakes investment in emerging tech, you’ll find George’s insights invaluable. 🎧 Listen to the full episode here:

Click to Listen to Latest Podcast

Acknowledgements

With huge thanks to our partner Mishcon de Reya.

Follow Us

Copyright (C) 2024 Oxford +. All rights reserved.

Our mailing address is:

Want to change how you receive these emails?

You can update your preferences or unsubscribe